China Starts to Lose Its Taste for McDonald’s and KFC

When it comes to China’s multi-billion dollar fast food industry, Yum! Brands Inc. and McDonald’s Corp. are living large, enjoying a combined 38 percent share of the market in 2015. Yum’s KFC restaurant chain and the Golden Arches have long enjoyed a run of super-sized growth as consumers craved a taste of Americana.

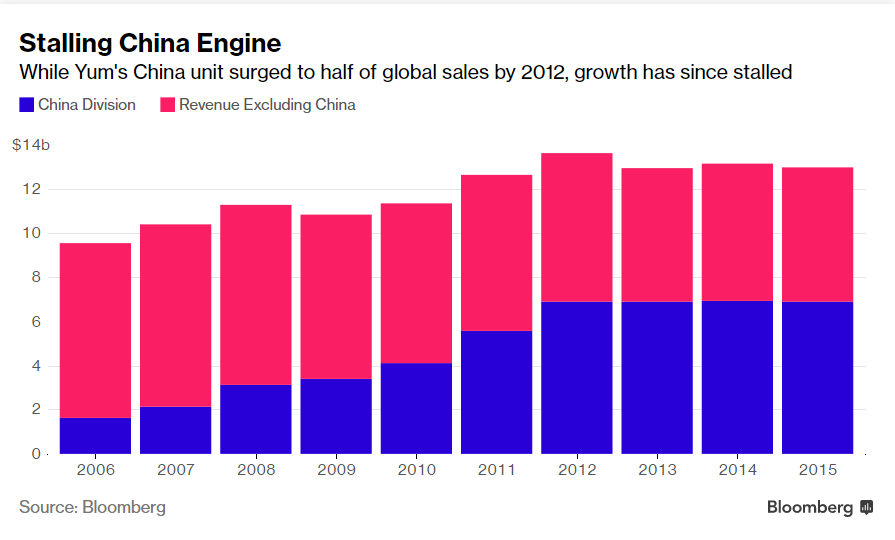

Now, as both these giants eye spinoffs of their mainland operations, analysts are wondering whether the glory days might be over. There are signs that both companies’ absolute dominance of a fast food industry they helped create is starting to slip away as consumers shift to healthier options and Chinese-style food chains—from huoguo (hot pot) to tangbao (steamed dumplings)—proliferate.

These headwinds may explain why investor interest in Yum’s and McDonald’s China operations has been tepid, at least so far. Yum’s plan to sell a minority stake to a Chinese partner seems on hold after bidders objected to the valuation and terms, while McDonald’s has seen a few potential bidders turned off by stringent deal conditions. Yum has reportedly valued a 20 percent stake in its China business, which it plans to list as a separate unit before the year’s end, at $2 billion. That’s the same price tag McDonald’s has reportedly put on its China franchise rights.

“There would definitely have been more buyer interest five years ago, but at that time they were doing so well that they couldn’t bear to sell,” said management professor Li Weihua of China University of Political Science and Law, who has written over 30 books on franchise management in China and credits KFC’s first store opening in 1987 as the start of the franchise industry in China. “With the bloom off the rose, if they don’t sell now, it would be worth even less five years later.”

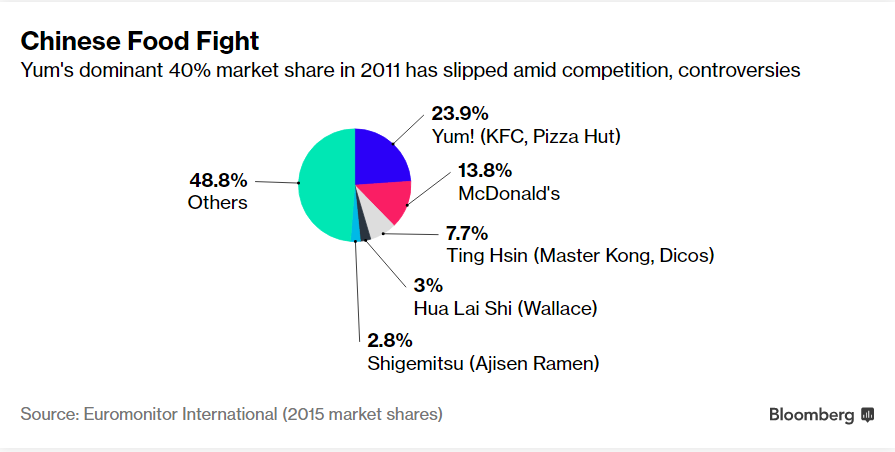

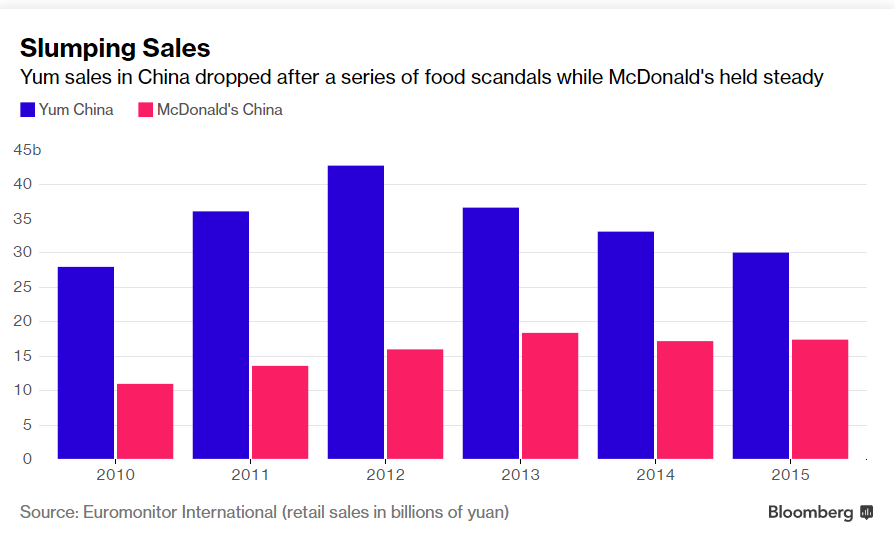

Yum’s fast-food operations in China, which also include Pizza Hut, are still sizable and span 7,200 outlets. Yet its total share of the market has dropped sharply from 40 percent in 2012 to 23.9 percent last year, while McDonald’s share has slid from a high of 16.5 percent in 2013 to 13.8 percent last year, according to data from Euromonitor International. McDonald’s has about 2,200 outlets across the country.

Tepid Appetite

McDonald’s has attracted interest from suitors like Beijing Sanyuan Foods Co, Sanpower Group Co and Beijing Tourism Group, according to people familiar with the bidding. Both have relatively modest restaurant franchises in their portfolios.

Other more established restaurant chains haven’t stepped forth. They include Taiwanese conglomerate Ting Hsin International Group, which has a 7.7 percent market share and controls the Dicos fast-food chain, as well as Hua Lai Shi Catering and Kungfu Catering, whose market shares are 3 percent and 2.2 percent, respectively. China Resources Group, operator of Pacific Coffee, has also taken a pass.

Pacific Coffee has a different franchise model from McDonald’s and Yum, and so it’s hard to have operation synergy if it buys the China business of the fast food brands, said Todd Li, Vice President of Pacific Coffee, in a phone interview on July 29. At McDonald’s and Yum, franchisees act more like investors and typically take over profitable and established company-owned outlets. Pacific Coffee is looking for experienced franchisees to operate new stores, Li said.

Potential buyers may be reluctant to spend billions on established fast-food brands that are already so familiar with Chinese consumers. Yum’s KFC chain opened up its first near Tiananmen Square in Beijing back in 1987.

“Companies already in this industry know that the brand might be big, but it’s outmoded in consumers’ minds. They would compare this to the amount of investment required of them,” said Hao Yongqiang, vice-director of the China Chain Store and Franchise Association (CCFA), which runs yearly expos linking fast food brands to prospective franchisers.

Big Gulp

The historical dominance of the two brands in the Chinese fast-food industry has also meant that there are almost no home-grown fast-food chains with enough experience and scale to run massive operations like Yum and McDonald’s.

“The problem with franchising in a developing country is how to control for quality. Not many players have the scale or depth that can take on the entire country’s franchise rights,” said James Roy, a senior analyst at China Market Research Group. “Dicos or Real Kungfu might also be waiting for the price to come down.”

For their part, both companies see profitable futures for their China operations. Yum China is providing high quality food and continually “adapting menus to cater to the evolving preferences of Chinese consumers,” said the company in an email statement. Yum! Brands has raised its annual core operating profit growth forecast to at least 14 percent from the 10 percent at the beginning of the year based on China’s strong performance in the first half this year and Yum China has a “massive runway for continued growth.”

Healthier Choices

McDonald’s China, in its email statement, also said it is committed to providing healthier choices such as whole-wheat McMuffins and chicken cereal congee (porridge) to customers in China. The company declined to “speculate further” on its efforts to sell off its franchise rights, according to the statement.

Yum’s KFC chain in China performed better than the company expected in the second quarter, after a two-year slump sparked by a food-safety scare, bird flu outbreak and competition from local restaurants. McDonald’s said that its same-store sales in its high-growth unit, which includes China and Russia, grew 1.6 percent in the latest quarter.

The popularity of KFC and McDonald’s in China has stemmed from their novelty as Americana, not their low prices, said China University’s Li. “Once the novelty factor wears off, there’s nothing keeping consumers going there as local chains are cheaper and often more dynamic in meeting local tastes and preferences,” he said.

Shares of McDonald’s have dropped 0.5 percent this year, while Yum has risen 21 percent.

The Chinese middle class is also upgrading to products in the “affordable premium” segment, accounting for the popularity of chains like Starbucks, which is opening up about 500 stores a year in the country.

“The volume that Chinese are consuming is not growing rapidly, but they are trading up in terms of what they are buying, and we are seeing this not just in the first and second-tier cities but across lower-tier cities as well,” said OC&C Strategy Consultant’s Greater China partner Jack Chuang. This trend is benefiting foreign consumer brands which have been positioned as premium from the beginning, like Danone’s Evian mineral water brand, he said.

“Chains like Starbucks are walking into the right moment now in China,” said CCFA’s Hao. “Just like how long ago, everyone wanted to eat hamburgers.”