Papa John’s tries new tack to challenge Pizza Hut, Domino’s for pizza supremacy

From dough to the box, we go behind-the-scenes at Papa John’s to learn all of the critical steps it takes to make the pizza that is delivered to your home perfect. USA TODAY

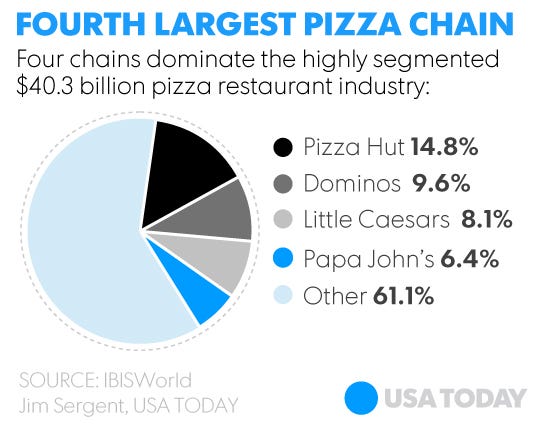

LOUISVILLE — The battle among America’s pizza chain juggernauts for a bigger slice of the $40 billion industry is about to get more heated.

In an era when industry leaders are offering two pizzas for as little as $10, Papa John’s — the country’s fourth biggest pizza chain in terms of market share — says it will launch an aggressive campaign to win more customers by making the case that spending a a few more bucks on your pie is worth it.

Company officials say their push will start during festivities in San Francisco ahead of the Super Bowl – historically the biggest day of the year for pizza sales – when the Kentucky-headquartered chain will have three of their NFL pitchmen J.J. Watt (a former delivery driver for rival Pizza Hut), Joe Montana and Archie Manning announce that Papa John’s will pledge that any customer dissatisfied with their pizza will get their next pizza free. (The company’s most celebrated endorser and franchisee Peyton Manning will be too busy preparing to play in the Super Bowl to take part in the pitch.)

The company plans to follow its celebrity push with a national television advertisement campaign the day after the Super Bowl to market their free pizza guarantee.

The brash move comes from a company that has touted a “Better Ingredient, Better Pizza” motto for about 20 years, while its competitors increasingly offer cut-rate deals, which have added a new dynamic to the war among America’s big four pizza chains. Pizza Hut, Domino’s, Little Caesars, and Papa John’s account for about 39% of the industry’s revenue.

Little Caesars, the third biggest chain in terms of sales, sells its large ‘hot-n-ready’ pizza for $5 in many markets. Industry leaders Pizza Hut and Domino’s have launched value menus where customers can buy two items—including pizzas, pasta, and desserts—for $10 to $11.98.

Papa John’s is hardly averse to offering specials. They currently offer one large, one-topping pizza for regular price with a second one for 50 cents. But with prices that skew higher than their bigger rivals—a large pepperoni pizza goes for $15.50 at Papa John’s in the Chicago market— their specials are significantly more expensive their big chain rivals.

“You can’t make a silk purse with a sow’s ear,” Papa John’s founder and CEO John Schnatter told USA TODAY. “You can’t make good wine from bad grapes. If you’re serving a $5 pizza, you are either serving ingredients that are not high quality or you’re putting less on.”

Pizza Hut, which recently launched what it’s calling its $5 flavor menu, declined to address Schnatter’s comments directly. But company spokesman Doug Terfehr noted the company has been “serving the same great-tasting pizza, at a great value” for more than 50 years.

Papa John’s first introduced the free pizza guarantee in the United Kingdom last year as it was trying to differentiate their brand from Domino’s Pizza, which dominates the UK pizza scene with nearly four times as many outlets as Papa John’s.

Papa John’s president and chief operating officer Steve Ritchie credited the campaign with helping boost same-store sales by “double-digit” percentage points in the United Kingdom last year. Fewer than 2% of their customers in Britain called up to complain and ask for a free pizza, Ritchie said.

Under the soon-to-be offered guarantee in the U.S., customers dissatisfied for any reason can call Papa John’s within 30 minutes of receiving their pizza and they will be offered a choice of having a new pie made for them on the spot or be credited with a free pizza for another day, Ritchie said.

Ritchie noted that Papa John’s has scored highest or tied for the highest marks among the top four pizza chains in the American Customer Satisfaction Index for 14 of the last 16 years. But Ritchie suggested Papa John’s must do a better a job differentiating itself from rivals.

“It’s really time to voice that loud and clear out to the consumer,” Ritchie said. “It’s something we’re very passionate about and prideful about. But have we conveyed what we do in the stores every day to the consumers?”

The company has seen solid sales growth in recent years. Same-store sales at stores open more than a year were up 5% for franchises and corporate stores in North America for 2015 through the end of the third quarter compared to the same period last year. Same store sales were up 7.5% in its international markets through the end of the third quarter.

Still, Papa John’s growth pales in comparison to the 12,000-store chain Domino’s, which has boasted same-store sales growth in the U.S. for six straight years. In the third quarter of 2015, Domino’s reported domestic sales grew 10.5% compared to the same period the previous year. The international division also posted same store sales growth of 7.7%, marking the 87th consecutive quarter of international same store sales growth.

Pizza Hut is the largest pizza chain with 15,000 restaurants worldwide, but is going through a turbulent period in which it has been the weak link for its parent company, Yum Brands, the fast food behemoth that also operates Taco Bell and KFC. Pizza Hut saw same-store sales grow just 1% in the third quarter. Yum, which won’t release its full fourth quarter earnings until next week, recently reported that sales at its Pizza Huts in China declined 8% in the last quarter.

Papa John’s Schnatter, 54, agrees the company needs to improve on telling its story. The CEO, who launched his pizza business out of a broom closet at his father’s bar, stars in company’s ads and has become the most ubiquitous face in the pizza industry.

Schnatter, who backed Republican presidential candidate Mitt Romney in the 2012 election, also drew attention after he told shareholders that President Obama’s Affordable Care Act would drive up the cost of pizza by 11 to 14 cents per order. The company’s Facebook page was littered with messages from critics who said they’d be happy to pay the extra cost if it resulted in workers being covered by health care.

Schnatter said he is confident the company can grow its customer base, particularly with millennials and busy mothers, by underscoring the company’s efforts to improve its quality.

“The consumer is more informed about what’s good and what’s not good—millennials especially,” Schnatter said “I think we’re skating to where the public is going.”

Papa John’s latest pitch follows the company’s announcement earlier this month that it has removed all artificial flavors and synthetic coloring from its food items. In December, the company said by this summer it will transition to using only chicken that is raised without human and animal antibiotics and that is fed an entirely vegetarian diet.

At Papa John’s quality control lab and dough factory at the company’s Louisville headquarter, the company has stepped up its effort to ensure a flood of dissatisfied customers won’t demand free pizzas once the company starts its quality guarantee promotion.

Production of 300 million dough balls a year for pizza crusts at Papa John’s hums along at 10 commissaries spread throughout the country, supplying more than 4,600 outlets. Even at that scale, the process of making pizza remains as much art as science, Schnatter said.

On the floor of the Louisville dough factory, one 13-person shift had well over a century of collective experience with the company. Schnatter said the the longevity of his workforce in key positions has helped make improving key facets of the business easier. It also hasn’t hurt retention that the company distributed $60 million in bonuses last year, he said.

“If you don’t get it right from here, you’ll see that the final product (isn’t) right,” Schnatter said over the ear-splitting din of dough being made.

Upstairs from the dough factory, a team of product quality technologists in lab coats randomly test thousands of food items from throughout the Papa John’s distribution system each month Checks include the acidity of the pizza sauce, the depth of the Papa John’s cookie-brownie dessert, and even the thickness of their pizza boxes.

Down the hall from the quality control techs, a half dozen young analysts huddle in cubicles where they review and grade 60,000 pizzas bought at Papa John’s outlets worldwide by secret shoppers.

Jordan Marr carefully studied an uploaded photo of a hot and spicy pizza from a restaurant in South Korea. Among the things Marr looked for was whether the pizza captured “cheese lock”— the all-important state of cheese hitting the crust—and proper topping spread so a diner would taste the jalapeño and meat in each bite of pizza.

Marr, 26, who got his start with the company working at a Papa John’s restaurant in college, gave the pizza an 8.5 on a scale of 10. The company says they want nothing graded below an 8 to be served to customers.

“You think pizza making is simple, but it is not here,” Marr said.