Yum China’s Ready to Export Mongolian Hotpot to the World

Yum China Holdings Inc., the fast-food spinoff that began trading in New York on Tuesday, is ready to step out of the shadow of its parent company.

The newly minted business, which owns the KFC and Pizza Hut brands in China, has a carte blanche opportunity to pursue growth, Yum China Chief Executive Officer Micky Pant said in an interview Wednesday. The company will add 600 restaurants a year in China and plans to export its Mongolian hotpot chain that’s popular in the country around the world.

“We really have no restrictions on us at all,” said Pant in Shanghai. “We have the flexibility to invest in anything we like. It’s a blank canvas for us.”

The separation follows a tumultuous stretch for the company’s Asia operations — Yum has been losing Chinese market share lately after a food-safety scare, changing tastes and more local competition took a toll. Yum China may now win more customers over by being considered a local business, according to Yum! Brands CEO Greg Creed.

“This is a Chinese brand; this is not a U.S. brand anymore,” Creed said in an interview with Bloomberg Television. The separation “reduces volatility and reduces risk.”

Yum shares rose about 8 percent to close at $26.19 in its first day of trading in New York. At $9.5 billion, its market value compares with $22.3 billion for Yum! Brands Inc.

To watch the interview with Greg Creed, click here.

To watch the interview with Yum China CEO Micky Pant, click here.

Pant said the company plans to use successful local strategies to grow — rather than tactics that work in the U.S. That includes rapidly adding new restaurants to hit a goal of more than 20,000 outlets within 20 to 30 years, compared to the 15,000 restaurants in the U.S., he said.

Yum China will also look outside of China for growth. The company plans to expand its Little Sheep hotpot outlets globally through franchises, adding to its 40 outlets in North America. “The place to sell Chinese food is outside China,” said Pant.

The only restriction on the company,“a gentleman’s agreement with Yum Brands,” is that it won’t compete in the same areas, said Pant. It isn’t actively looking for new acquisitions, he said.

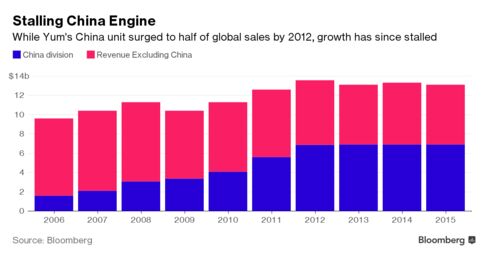

Corvex Management founder Keith Meister, an activist investor, began advocating for the spinoff in mid-2015. He argued that the Chinese operations — which contribute about half of Yum’s sales — could generate an additional $16 a share in value for the Louisville, Kentucky-based company.

Yum China has a tough task ahead of it. The company’s total share of the Chinese market for fast-food chains dropped to 30 percent last year, from 40 percent in 2012, according to data from Euromonitor International. It has suffered from consumers shifting to healthier options and domestic chains sprouting up with more variety.

Unlike Yum’s U.S. operations, where most of the restaurants are run by franchisees, Yum China directly operates over 90 percent of its outlets and plans to triple the number to more than 20,000 in the long term.

And Yum could be a model for other companies, said Shaun Rein, a Shanghai-based managing director of China Market Research Group.

“When their China operations get so big and are clearly catering just to the China market, splitting off could unlock a lot of value for shareholders,” he said. “If I were an activist hedge fund investor, I would be looking at carving out brands within large conglomerates that are China plays.”

— With assistance by Rachel Chang, and Leslie Patton

Source:Bloomerang